We are building a strong team of self-motivated employees who are empowered to take responsibility in a collegial working environment.

We listen carefully to our customers, because only by being responsive to their needs we can guarantee lasting success for us.

We focus on the development of innovative high-end products. Our driving force is real added value for our customers.

We achieve our goals quickly through simple solutions to complex problems.

We continuously strive for improvement to get the best out of ourselves.

We generate value to foster a sustainable and growing corporation that can withstand the complex challenges of a highly competitive industry and demanding markets.

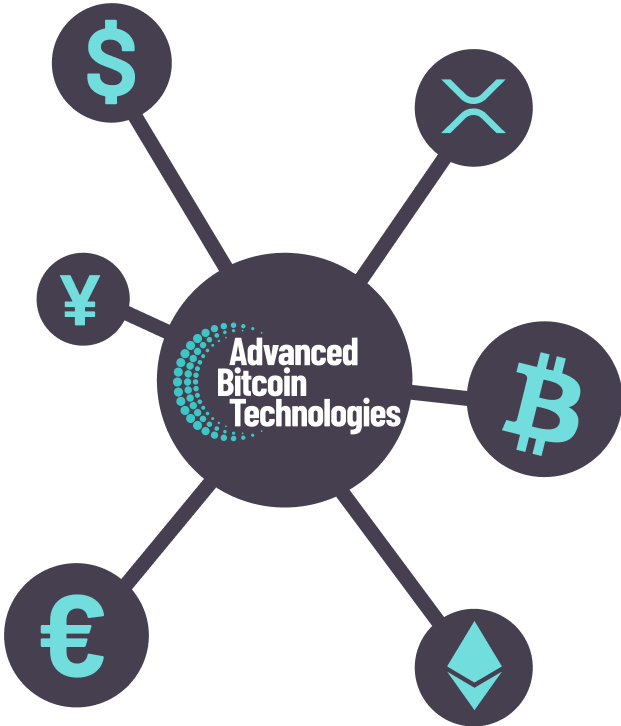

This multi-currency transaction platform will be the core, i.e. the backend, of the future product portfolio and will comprise the following four basic functionalities:

This multi-currency transaction platform will be the core, i.e. the backend, of the future product portfolio and will comprise the following four basic functionalities: